Archive for June, 2008

China-Peru begin 4th Round of Negotiations for a Free Trade Agreement

Posted in Uncategorized on June 29, 2008| Leave a Comment »

China – Peru, 4th Round of Negotiations for a Free Trade Agreement between China and Peru began yesterday, June 28th in Lima, Peru according to Andina, a leading Peruvian news agency.

Topics on the agenda in this round include:

– Access to the Market,

– Rules of Origin,

– Trade Defense,

– Services,

– Investments,

– Sanitary and Fitosanitary Measures;

– Technical Obstacle to Trade,

– Solutions of Controversies,

– Customs Procedures

– Institutional Affairs.

Updates and developments to come. It seems both China and Peru are eager to sign this agreement. It would make it China’s second in South America, Chile having already sealed a FTA with China back in 2005. (Click here to read the article published by the China-Daily, back in 2005)

Peru and Chile are attractive countries for China because of a variety of reasons. First, Peru and Chile are the world’s leading copper producers. In 2004, the two nations, together mined nearly 6.4 million tonnes of copper; equal to 44% of global copper production. Together, the two countries accounted for 50% of China’s total copper imports from abroad (International Copper – World Copper Study Group; 2007). Chinese copper demand is unlikely to shrink any time soon, granted the fact copper is used in the production of semi-conductors, automobiles, infrastructure, IT hardware, and in the construction industry (Trinh; 2006).

Second, macroeconomic and political stability and impressive growth makes Peru and Chile ideal entrance gates for Chinese investments, exports and imports to and from Latin America. Chinese ambassador to Peru, Gao Zhengyue, stated this year at a conference on pacific cooperation hosted in Lima; “one of the advantages that Peru (and Chile) offers to China as economic partners is its strategic economic convergence of complimentary economic structures. Derived from its geographical position in the continent, as a bridge between Asia and South America and the Atlantic Ocean through the bio-oceanic corridor. Peru is also important due to its projection towards a sub regional extended market through the Andean Community (CAN) and Mercosur. (China-Peru Free Trade Agreement Joint Feasibility Study; 2005-06).”

It would be nice is China and Peru could get this deal sealed and further increase trade with one another. It will be to the benefit of both countries. Reported on Chinese Governments homepage of the Ministry of Commerce, Vice Minister of Commerce Yi Xiaozhun stated:

“Peru is now China’s important trade and investment partner in Latin America. The China-Peru bilateral trade surged by 49.59% year on year to US$6.014 billion, out of which China’s export hit US$1.678 billion, up by 66.43%, and China’s import hit US$4.336 billion, up by 49.03%. The cooperation on mutual investment, contract projects and labor cooperation, etc., between the two countries also enjoys relatively quick development.”

Many would agree other countries are equally or of greater significance to China… Such as the closest competitor to Peruvian copper–Chile. Perhaps Brazil, which China has become increasingly dependent upon for foodstuffs and is has also heavily invested in infrastructure, iron ore and energy projects throughout Brazil.

No less, Chinese rhetoric however exaggerated, does offer some evidence to suggest the agreement will pass and be speedily implemented. China can be very respectful, gracious and giving when they want something to move ahead. Whether Peru is truly emerging as China’s most “important” partner in Latin America is questionable, but China’s and the Peruvian governments efforts to move this foward, show both parties feelthe FTA would be beneficial.

ProInversion board to okay Pisco-Lurin pipline contract — investment opportunities in Peru!

Posted in Uncategorized on June 29, 2008| Leave a Comment »

BNAmerica‘s reports ProInversion, Peru’s state agency for promoting private investment is due to release purchasable contracts to private investors willing to buy them.

BNAmerica‘s reports ProInversion, Peru’s state agency for promoting private investment is due to release purchasable contracts to private investors willing to buy them.

Grana y Montero, a local Peruvian company and Oiltanking, a German firm will construct a 300km from the province of Pisco to a dispatch plant in Lurin, which is within the district of Lima. Construction of the pipeline will take approximately 30 months once all financing is approved.

I learned today through researching this particular “investment,” ProInversion allows private investors to invest in numerous infrastructure and state projects of the Peruvian state. Although the English site is a little vague on how the investment works, it is interesting to see such a site exists and that the Peruvian state has managed to package the debt of such products into purchasable and tradable forms.

Investors, seeking a alternative avenue to diversify their investment should consider such investments. ETF’s and mutual funds, or even direct purchase of equity is risky considering the current state of the global economy and the world’s financial markets.

I am sure many situations from the past can be pointed out by others who are aware of them of times when Latin American government have issues similar “bonds” or purchasable equity to finance their own projects… only to never pay their investors back. People have good reason to be worried, but ask yourself… in today’s market, what investment comes with “no worries?”

Video — Investing in Peru

Flooding continues in Southern China as new tropical storm hits South China

Posted in Uncategorized on June 29, 2008| Leave a Comment »

Local residents are trapped in floods in Heyuan city, south China’s Guangdong province, June 27, 2008. (Xinhua Photo)

Local residents are trapped in floods in Heyuan city, south China’s Guangdong province, June 27, 2008. (Xinhua Photo)

Armed police transfer trapped residents in Heyuan city, south China’s Guangdong province, June 27, 2008. Affected by Typhoon Fengshen, heavy rainfall hit Heyuan on Thursday and Friday, flooding some roads and houses. Over 2,000 local residents have been transferred to safe places by the armed police.(Xinhua Photo)

Reuters Video Footage – China Flooded by tropical storm

The Shanghai Stock Exchange unveil’s new rules intended to prevent investor fraud and manipulation of securities

Posted in Uncategorized on June 29, 2008| Leave a Comment »

New rules unveiled by the Shanghai Stock Exchange summarized below… Or view the full story on Xinhua’s website, accessible here.

New rules unveiled by the Shanghai Stock Exchange summarized below… Or view the full story on Xinhua’s website, accessible here.

Proceeds from initial public offerings (IPO), private placements and bond sales should be put in an account opened by the board of directors, the rules said.

Listed firms should notify underwriters if they want to cash in more than 50 million yuan (7.3 million U.S. dollars), or at least 20 percent of the proceeds, from an account, the bourse said.

The proceeds should not be used to buy tradable financial assets or lent to others. It is also banned from being invested in stock funds or in companies mainly engaging in buying and selling securities.

China and South America in focus: China considers boycott of Australian BHP Billiton… could help Brazil’s Vale

Posted in Uncategorized on June 27, 2008| Leave a Comment »

The Chinese are considering a boycott of BHP Billiton (BHP), the world’s largest miner, according to a report by London-based investment bank Fairfax (article from BNAmericas).

Rio Tinto and China’s Baosteel, recently announced a joint venture deal, which China now argues exports iron ore, (one of Brazil’s major exports to China) at a fair market price while Australia’s BHP Billiton does not…

Interesting being that it cost $45/t more to ship Iron Ore from Brazil to China than it does from Australia to China. Despite the distance, the recent 100% increase imposed by the company (BHP) on Australian iron ore, makes iron ore from the Australian mining giant with more expensive ore than China can obtain 1000’s of miles away from its Brazilian counterpart.

Dangerous move for BHP, but in the end it might work out considering that BHP and RIO combined export about 80% of the world’s iron ore, even if RIO can hold out for a while and BHP feels the pain from the Chinese boycott, the global macro economic conditions of the commodity market, combined with the market share BHP currently retains may force RIO to raise its prices as well.

Pedro Galdi, an analyst at SLW Corretora brokerage firm in Brazil, stated the following:

“In reality, Vale- Rio Tinto (RIO) and BHP account for 80% of global [iron ore] mining needs. Demand is higher than supply and it’s hard to imagine one of these players leaving this market, or selling iron ore at spot prices, which could be bad for everyone,” said Pedro Galdi.

“I do believe this is going to become a duel of giants but it’s still too early to say that BHP is going to be selling at spot prices during this year, especially with its acquisition attempt of Rio Tinto. We have to wait until June 30 to see what is going to happen,” Galdi said.

Once again, if you would like to read the full article please visit BNAmericas or click here for a direct link to the publication.

China’s Muslim Uighur minority, call for Olympic boycott… not just Tibet

Posted in Uncategorized on June 27, 2008| Leave a Comment »

Xinhua Finance – XFML – Stock Update — CEO and Independent Directors Purchase Company Shares

Posted in Uncategorized on June 26, 2008| 2 Comments »

I’ll admit… I jumped on the “bandwagon” of Chinese IPO’s in early 2007, through the form of Xinhua Finance (XFML). I analyzed the stock as I did most my other Chinese picks at the time. With little history on the company, horrendous management (at the time), little clue on how to deal with press and transparency. What So as a result…

(If you missed my first post on XFML, click here to check it out.)

I made the investment with a simple macro-economic analysis of the Chinese market, believing the stock’s debut on the NASDAQ at around 11-12/share as a fair price. After a year of turmoil both within the company, in Asian markets, and with global markets around the world in general the stock has sat and done little except inch it’s way down to the current price of $2.66/share. The “good times” in 2006 had gotten to me as they had many people playing Asia.

Good news is on the horizon… just in time for the Olympics which scares me a bit, especially considering I’m sure XFML, which has a decent amount of debt, is hoping the Olympics boost their “brand,” and that the advertising projects it has been hired to do for the games actually bring in some solid revenue… which would also help their share price.

Raising money in the current market would be hard. XFML suffered some bad publicity earlier in this year, do your own research if you want details since much of it in my opinion was based off unfounded facts, over-exaggerated and politically motivated.

They hired new PR, reshuffled their board and management, have revamped their main financial news page: http://www.xinhuafinance.com/en/, acquired some nice companies for decent prices this year, saw revenues rise in all their current operations (including print media), got some nice projects for the Olympic games, and are about to expand into sports media– a largely untapped market in China.

Now to top it all off, this morning in my mail box I was sent a pleasant news break on the company, informing me Freddy Bush, the CEO and Independent Directors Purchased Company Shares due to their feeling of the company “being undervalued.” Generally good news.

Not saying go out and buy, this website represents my opinions, commentary and analysis alone and not the actual course of events that will play out. Please invest with caution.

For full article regarding the purchase made by the CEO and other directors click here for Yahoo Finance’s link to it. I’ll copy the companies performance once again of XFML since it’s debut last year.

Hilarious headline flashed earlier on Bloomberg Live TV "breaking news"…

Posted in Uncategorized on June 25, 2008| Leave a Comment »

“Texas real estate slump lets Mexicans take it back.”

Thought I would share that, lol. Goodstuff Mexico!

US-listed Chinese Stocks in Focus — Xinhua Finance Consumer Confidence Index Inches up

Posted in Uncategorized on June 25, 2008| 1 Comment »

Beginning in September of 2007, I started to get accustomed to reading reports of slumping consumer confidence in China. Every month, Xinhua Media, one of China’s premier financial information and media service provider emails me a copy of their benchmark consumer confidence index they started in April 2007. This month (June), consumer confidence inched up for the second time since September of 2007, the other gain being the month of March– which can partially be attributed to recovery efforts after a week long freezing snow storm which crippled southern China in late winter.

In this case too, investors should remain cautious, as the analysis released along with the new figures in indicate, confidence rose in certain areas of China and dropped in others. Among China’s major cities, consumer confidence rose in Beijing and Ghuangzhou while it fell in Shanghai. Overall, below is long-term picture of the Xinhua Finance eziData China Consumer Index.

Xinhua Finance is one of China’s domestic premier financial information and media service provider. Listed on Tokyo’s Mothers Board (9399), Xinhua Finance is headquartered in Shanghai, with a global network spanning 12 countries worldwide.

Xinhua Finance is one of China’s domestic premier financial information and media service provider. Listed on Tokyo’s Mothers Board (9399), Xinhua Finance is headquartered in Shanghai, with a global network spanning 12 countries worldwide.

Beijing’s gain can be attributed in large, due to the upcoming Olympic games in August. Overall gains in the index, as described in the report can be attributed to two major factors;

“continuously easing general price rises due to the central government appreciating the RMB (yuan) and acting correctly to stem inflationary pressures. Second, encouraged patriotism among average Chinese from the Wen Chuan earthquake rescue efforts, which in a very abstract sense thereafter encouraged consumers to remain more enduring when facing difficulties.”

Now the investor at this point should ask him/her self… Is it time to get into China? Big names like Jimmy Rogers say yes, but realize they know the market beyond just the scope of China. Rogers knows and analyzes much of his China picks within the larger context of Asia and more particularly, the global commodity market.

Jimmy Rogers for instance has recently focused on Taiwan’s market, and made comments on Japanese stocks being relatively “under-valued.” This does not mean it’s time to pour your assets into stocks from the mainland, although major financial media that blizt’s viewers with anything he says have interpreted it as such.

For the long term investor out there… It is difficult with a lack of transparency and speculative investment in many Chinese ADR’s, to really value most stocks accurately. No less, here are some equities on my China watch list, two of which I currently own.

Note I do not own all these stocks, I’ll admit to buying shares of XFML and CHCG.OB recently, and that I used to own CAGC.OB, but, I no less still follow these stocks and feel these five in particular have become more attractive in light of recent pull backs, leaving XFML, CHCG and CAGC under-valued by the market.

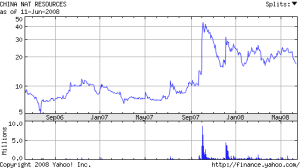

GRO and CHNR less so, and I know less about the two companies leaving me apprehensive about investing in either. I also question the true profitability of CHNR, which I feel has a great deal of hidden debt will find the Iron, Zinc and Copper mines in operation and their exploration projects within China will not yield as much raw material as the company has projects.

1) Xinhua Finance – XFML, as described above is a leading provider of financial news in China. The company I receive the monthly consumer confidence report from, and which I am personally invested, is involved with more than just financial news. They provide advertising services to upscale Chinese firms, own the rights to certain TV stations in China, own newspapers (which are not suffering declining circulation as they are in the US and still used as the primary medium of obtaining news in the mainland), among other operations.

2) China 3c Group – CHCG.OB.

*** now for three commodity related plays, two in the agriculture sector and one in metals, which I am personally weary of despite all the hype surrounding it– China Natural Resources Inc

3) China Agritech Inc – CAGC.OB

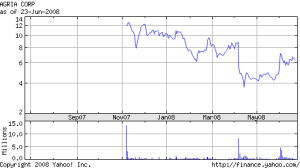

4) Agria Corporation Inc – GRO

5) China Natural Resources Inc – CHNR